Table of Content

The repayment duration is the same as the tenure of the home loan as Equated Monthly Instalments . This is available to new home loan customers and also to existing home loan customers who have chosen the SBI Life Cover. SBI Bank has been in the financial service providing industry for a very long time. They are trusted service providers, therefore, getting an SBI Home Loan at a favorable interest rate will be a good decision. But for comparison purposes, use the SBI Home Loan EMI Calculator to compare various EMIs using different interest rates, loan amounts, and tenures.

Interest rate- the cost for taking a loan is the interest rate paid on it. The higher the interest rate, the higher will be the cost of the loan and the higher the EMI amount. Thus, before taking the SBI Home Loan, make sure to compare various interests so that the borrower can get a loan at a lower EMI.

Popular Products MyMoneyMantra

Maxgain Home Loan is an innovative and customer-friendly product enabling the customers to earn optimal yield on their savings by reducing interest burden on Home Loans, with no extra cost. The maxgain calculator allows you to calculate the savings in comparison to regular home loan. Home Loan Balance Transfer calculator allows you to calculate benefit of transferring your home loan from any bank to SBI. The SBI Home Loan EMI Calculator provides such an EMI amortization schedule. This schedule breaks down the entire repayment and the borrower can see if they can afford to pay the monthly EMIs. This schedule can also be emailed to the borrower for record-keeping.

The loan repayment linked to BPLR would be costlier due to this. The bank has also raised the base rate by similar basis points to 8.7 per cent. SBI home loans have a consolidated processing fee which is 0.40% of the loan amount plus the applicable GST.

Farm Mechanization Loan

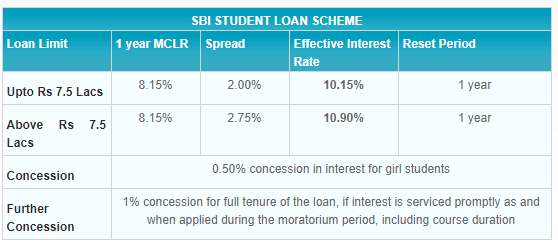

The processing fee on these loans is 0.35% of the loan amount (Min. Rs.2,000; Max. Rs.10,000) plus applicable taxes. Women borrowers are also offered an interest concession of 0.05% on SBI Home Loans. No hidden charges and a full waiver of prepayment charges make them one of the most preferred housing loan products in the country. SBI home loan EMI calculator is an ally both for the loan borrower and lending company.

You can also negotiate a bit on the rate with the loan provider. It should be noted that SBI is offering a festive offer till January 31, 2023. However, you can only pay one extra EMI than the usual number of EMI each year. TDS certificate on Form 16 or copy of IT Returns for last two financial years, duly acknowledged by IT Dept. Proof of residence (recent Telephone Bills/ Electricity Bill/Property tax receipt/ Passport/ Voters ID card).

Comparison of SBI Home Loan EMI with other Popular Banks

It ascertains the maximum EMI you can spend, with regard to your net monthly income and expenses . Usually, the lenders accept about 50% of your monthly income to be consumed by EMIs or other fixed obligations. If such obligations exceed further, the bank may either reduce the loan amount or may increase the loan tenure. You may also pay back some of the existing short-term loans so that the FOIR gets improved.

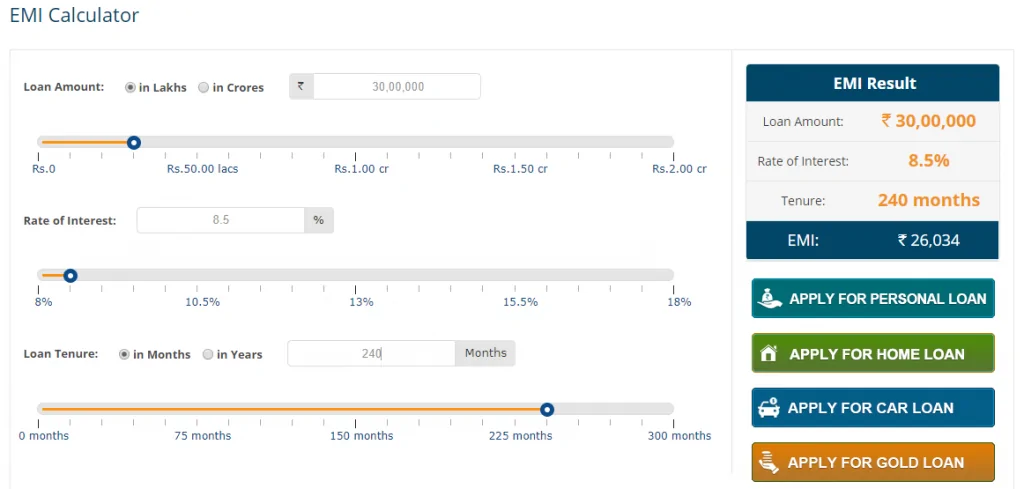

All one needs is the information of the principal loan amount, rate of interest, and loan tenure. In order to get a home loan, the bank will first assess your financials in order to confirm whether you are able to pay the EMI on time. In ahome loan calculator, you need to mention the loan amount, the home loan interest rate and the tenure for which you want to take the loan. Based on these details, you get the table with the information about the EMI, the total interest outgo and the total amount (interest+principal) for each year till the last year of the loan. The maximum funds of loan that can be offered to a customer can range up to Rs 15 crores with a comfortable repayment of ten years. The SBI Home Loan Calculator is the first step you take in applying for a home loan.

The risk premium is based on the CIBIL score; the lower the credit score, the greater the rate of the risk premium. The SBI home loan calculator will help you calculate the total monthly EMI and interest amount you would have to bear even before applying for the loan. The calculator helps you to plan your repayment process in advance. It clarifies to the borrower to assess and determines monthly EMIs they’ll bear against the loan. For SBI balance transfer loans, is the pre-payment penalty also included? Yes, the prepayment penalty will be funded in the SBI balance transfer loans but the total loan amount will be subject to the eligibility as per the relevant SBI home loan scheme.

No, SBI Home Loan EMI Calculator is not the same as SBI Home Loan Eligibility Calculator. The SBI Home Loan EMI Calculator tells you about the EMI value. It is dependent upon loan principal, loan term, and the rate of interest. Whereas the SBI Home Loan Eligibility Calculator tells you about the maximum amount of home loan the borrower is eligible for. It is dependent upon the income, job profile, age, and credit score of the applicant. In this method, the lender considers the ratio of your fixed income to obligations.

Through prudent use of the SBI home loan EMI calculator, the borrower can also figure out the required values for principal amount and loan tenure. Easy Calculation - The mathematical formula of the Home Loan EMI Calculator is complex. The use of the SBI Bank home loan EMI calculator makes this calculation easy.

Loan tenure- this tenure is the period within which the borrower needs to pay back the loan amount. The longer the tenure of the loan, the lesser will be the EMI amount. Thus, if the borrower takes a loan of 30 years then, compared to a 5-year loan, the EMI will be lower.

So, to calculate the EMI using SBI Home Loan EMI Calculator, check with the SBI bank to find the current interest rate. Get an amortization schedule- the SBI Home Loan EMI Calculator can provide a detailed amortization schedule that consists of the breakdown of the EMI amount into interest and principal. This way the borrower can clearly keep track of the interest and principal repayment throughout the tenure. To calculate the SBI Home Loan EMI- the borrower can freely use the SBI Home Loan EMI Calculator to calculate the monthly EMI of an SBI Home Loan with different tenure.