Table of Content

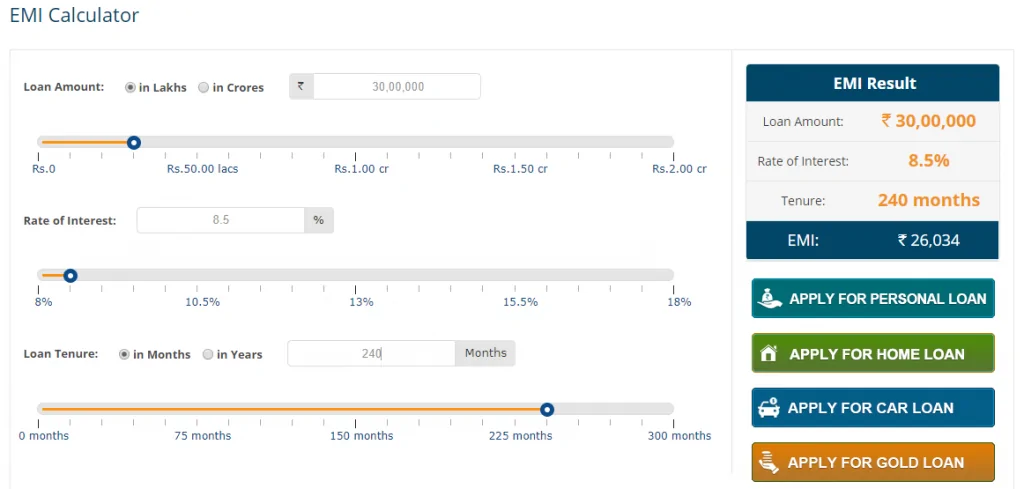

Longest loan tenure available across banks and NBFC’s in India for buying a home on a loan is around 30 years, subject to borrower’s current age and retirement age. Cost of Loan – In addition to the EMI value, SBI home loan interest rate 2022 EMI calculator also apprises the user of the total interest outflow on the home loan amount. As longer loan tenures have higher interest implications, the borrower can reduce the loan tenure or principal amount to reduce the loan cost. With a loan EMI calculator, you can prepare yourself in advance for the future payments and manage the finances accordingly. Also, you can use it as many times as you want not only before applying for a home loan, but even during the loan to know how much you have paid and how much you is left to pay. According to the SBI's official website, the higher rates will take effect on June 1, which is next week.

SBI Home Loan EMI calculator results depend upon the values of loan principal, loan term, and rate of interest offered by SBI Bank on home loans. By entering the values of the three parameters in the SBI Bank home loan EMI formula, the borrower can gauge the corresponding EMI value. The result will also show the total interest component of the home loan.

Loan Against Property

Borrowers with a credit score of 750 to 799 will have to pay a 7.65% interest rate with a risk premium of 10 basis points. SBI has increased the marginal cost of fund-based lending rates by up to 0.10% effective from 15 July 2022. It offers dependable housing schemes at affordable and competitive lending rates for Home Loans. The SBI Home Loan EMI Calculator allows the borrower to estimate the monthly instalment and thus make an informed decision regarding the loan principal and loan tenure.

It is evident that on a longer tenure, the interest payout is more against that on a shorter tenure. You should choose tenure that you are comfortable with, keeping in mind the total payout every month. However, each month, the principal repaid and interest payment proportion will be different in every EMI. Once the documents are reviewed and the Home Loan is approved, the loan amount is disbursed into your SBI account. Once the lender informs you on the amount you may be eligible for, you may proceed with submitting all your documents online for loan processing.

Can we pay more than EMI in home loan SBI?

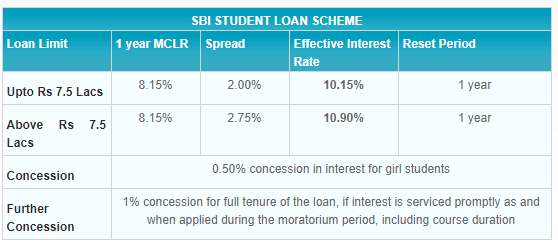

State Bank of India has raised its marginal cost of funds based lending rate on a few select tenors by 25 basis points from 7.60% to 7.85% for overnight MCLR and 7.75% to 8% for one-month MCLR. According to the latest update on the SBI website, these changes will take effect from 15 December 2022. While calculating the EMI for a loan, you should know the amount which you will have to pay when you take up a loan of the said amount, the tenure, and also the interest rate.

The SBI Flexipay home loan has the potential to lure a large section of home loan buyer towards SBI. The online SBI Home Loan EMI Calculator provides an accurate estimate of the EMI amount that needs to be paid to clear eth debt. Knowing this amount beforehand can help with planning the monthly budgets and see if the borrower will be able to pay the amount timely without any defaults. This is why it is recommended to use the SBI Home Loan EMI Calculator before getting the loan.

KOTAK MAHINDRA BANKHome Loan

The minimum amount is Rs.10,000 plus GST while the maximum amount is Rs.30,000 plus GST. Pradhan Mantri Awas Yojana can help you save money on your first house. Under the scheme, you can get subsidy of up to Rs.2.67 lakh. The subsidy is available to individuals earning up to Rs.18 lakh per year.

Before taking a home loan from SBI, it’d be a good idea to check whether you will be able to pay the monthly instalments. Just enter the proposed loan amount, the tenure of the loan, the interest rate the bank is offering you, and the processing fee. Not entering the processing fee will not affect your results, but the other three inputs are mandatory to get precise results. SBI Flexipay Home loan provides an eligibility for a greater loan. It offers customer the flexibility to pay only interest during initial 3-5 years and thereafter in flexible EMIs. This variant of SBI home loan is very useful for young salaried between years.

Life Insurance

The loan repayment linked to BPLR would be costlier due to this. The bank has also raised the base rate by similar basis points to 8.7 per cent. SBI home loans have a consolidated processing fee which is 0.40% of the loan amount plus the applicable GST.

All one needs is the information of the principal loan amount, rate of interest, and loan tenure. In order to get a home loan, the bank will first assess your financials in order to confirm whether you are able to pay the EMI on time. In ahome loan calculator, you need to mention the loan amount, the home loan interest rate and the tenure for which you want to take the loan. Based on these details, you get the table with the information about the EMI, the total interest outgo and the total amount (interest+principal) for each year till the last year of the loan. The maximum funds of loan that can be offered to a customer can range up to Rs 15 crores with a comfortable repayment of ten years. The SBI Home Loan Calculator is the first step you take in applying for a home loan.

SBI has raised loan interest rates with effect from December 15, 2022. SBI easy home loan EMI calculator, by simply entering the loan amount, interest rate and select the loan tenure from drop down. The repayment tenure is up to 10 years, However, depending on your profile, age and income. You’ll also find a table below that’ll give you a brief on how the repayment process will work against your loan balance. The Interest rate also significantly impacts the monthly EMIs. If the interest rate on the home loan increases, it will add to the EMI and ultimately escalate the loan cost.

You can also negotiate a bit on the rate with the loan provider. It should be noted that SBI is offering a festive offer till January 31, 2023. However, you can only pay one extra EMI than the usual number of EMI each year. TDS certificate on Form 16 or copy of IT Returns for last two financial years, duly acknowledged by IT Dept. Proof of residence (recent Telephone Bills/ Electricity Bill/Property tax receipt/ Passport/ Voters ID card).

Individuals must have a good CIBIL score to avail the offer. Your monthly instalment towards repayment of a housing loan must suit your pockets. Remember that delaying or missing payments will affect your credit score.

The processing fee on these loans is 0.35% of the loan amount (Min. Rs.2,000; Max. Rs.10,000) plus applicable taxes. Women borrowers are also offered an interest concession of 0.05% on SBI Home Loans. No hidden charges and a full waiver of prepayment charges make them one of the most preferred housing loan products in the country. SBI home loan EMI calculator is an ally both for the loan borrower and lending company.

The amount of instalment every month is lower if you choose a longer tenure. Below given is the housing loan information by State Bank of India. You can also visit an SBI bank branch directly to apply for a Home Loan. Once you submit the application, you will be given a reference number.

Proof of identify (Voters ID card/ Passport/ Driving licence/ IT PAN card). Copy of Form 16 for last 2 years or copy of IT Returns for last 2 financial years, acknowledged by IT Dept. SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans. Please get answers to your common queries regarding the home loan, security, EMIs, etc.

No comments:

Post a Comment